Capitalization Rate (Cap Rate)

QUESTION:

Does HousingAlerts tell or show the Cap Rate / Market Cap Rate for Apartment buildings?

ANSWER:

HousingAlerts can and should be used to SET the risk adjusted Cap Rate so you can compare deals/properties in different markets on an apples-to-apples (risk adjusted) basis.

For example, a property in a crummy market should sell for less (higher Cap rate) than the 'same' property in a hot appreciating market.

How do you adjust cap rates so you can evaluate properties on a risk-adjusted basis if they're in different markets?

A quick and easy way to evaluate Market Risk (CAP rate) for similar properties in different markets is to use the HousingAlerts "Master Score (Percentile)" at the MSA/City level.

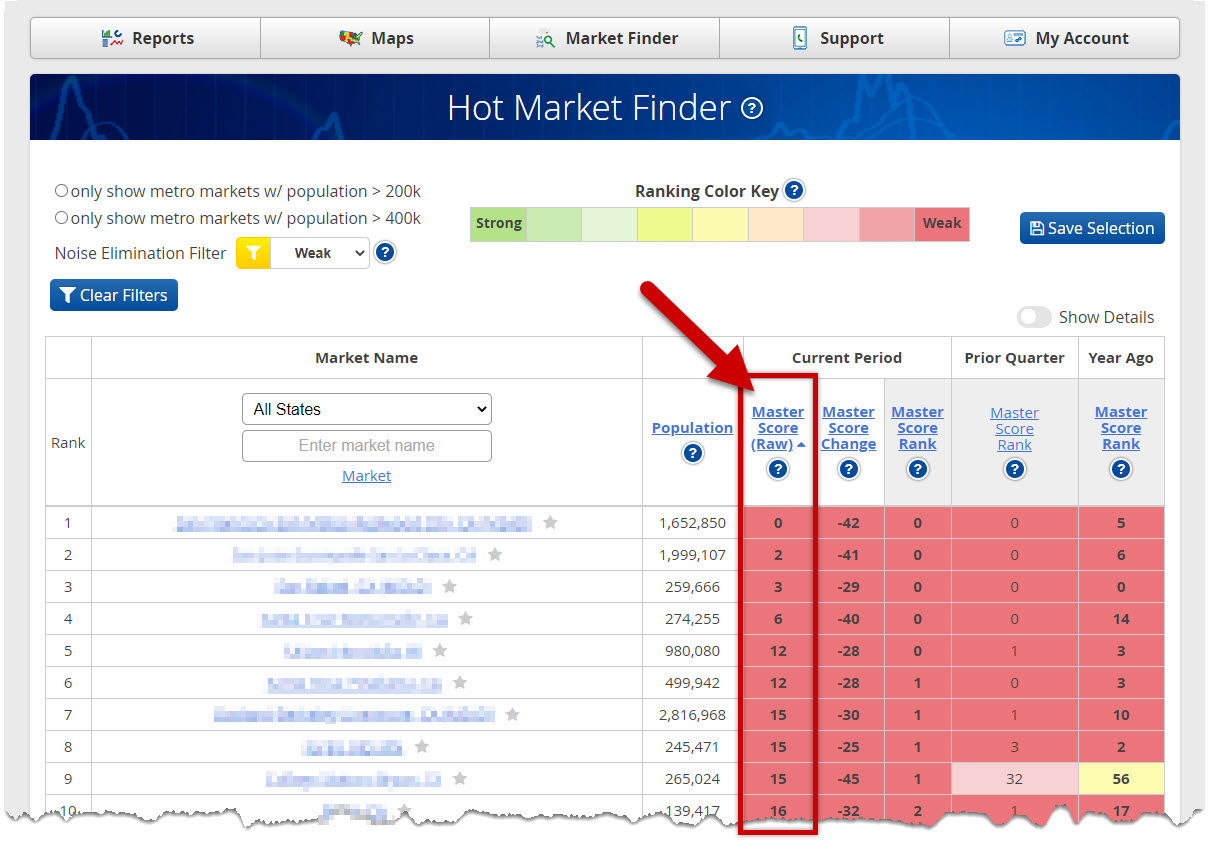

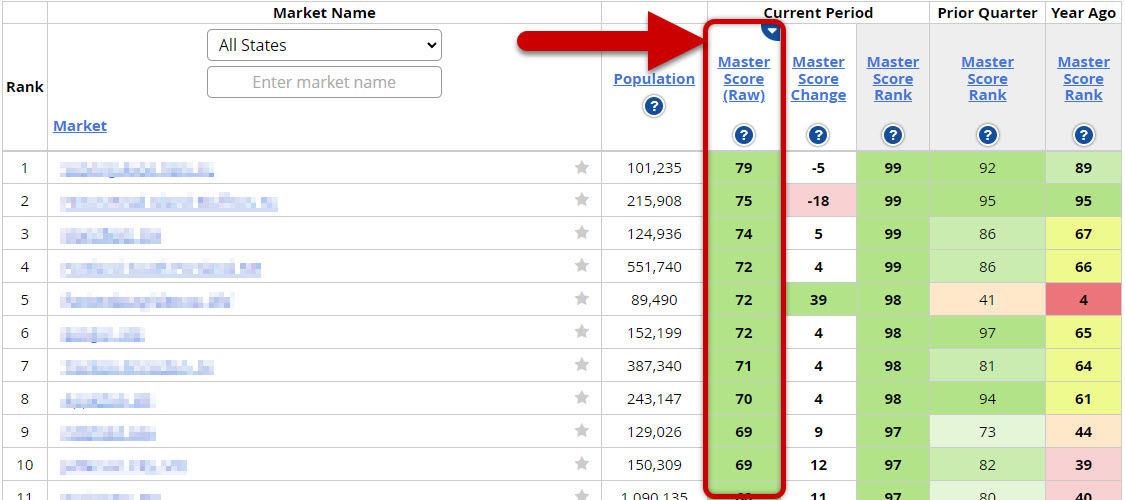

The Hot Market Finder tool ranks each city based on its Master Score.

The higher the Master Score ranking, the more likely that property will generate better returns RELATIVE to a similar property in a weaker market.

Markets with a higher Master Score are worth more and should command a higher price (lower CAP rate) than the same property in a weaker, riskier market.

A LOW master score means the opposite... it's a RISKIER market. You should require a higher going-in CAP rate (lower purchase price) for the same type of property but in a riskier market.