Technical vs Fundamental

Ever since there’ve been markets and cycles, investors have been trying to predict what’s going to happen next. You can reap huge rewards if you get that one piece of information correct.

Trillions of dollars and billions of man-hours have been spent over the last 100 years trying to figure out how to best predict market cycles.

Two methods have evolved:

1) Technical Analysis (‘TA’)

2) Fundamental Analysis (‘FA’)

These two methods apply to ALL types of markets and cycles: Stocks, Bonds, Commodities and, of course, Real Estate.

Fundamental Analysis was used almost exclusively until the 1980’s because it was the only method available (unless you were a big, elite Wall Street investment bank)

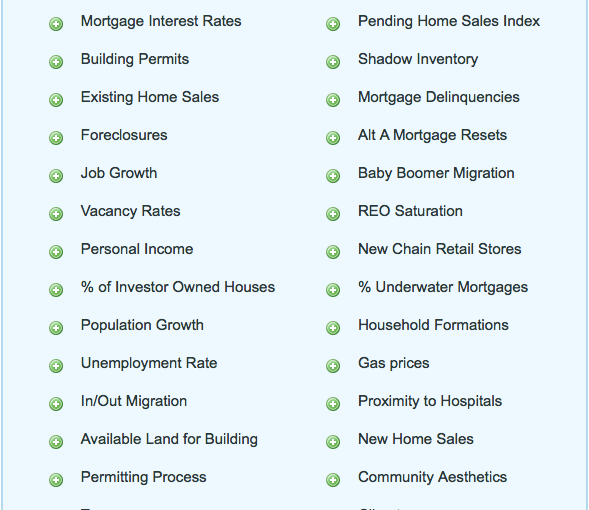

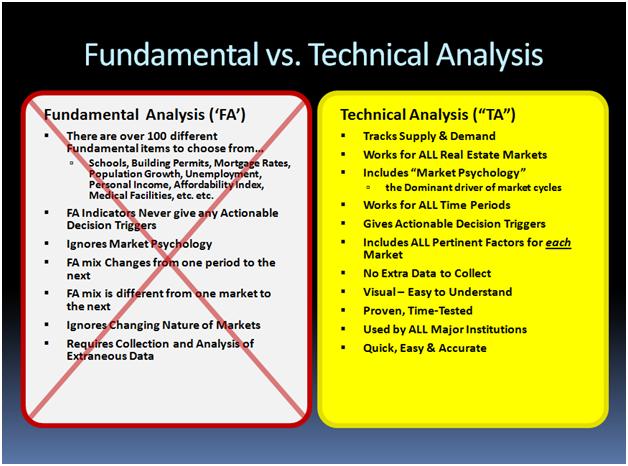

FA attempts to predict future prices by collecting and analyzing endless groups of data that supposedly relate to the market you’re investing in.

There are hundreds of other Fundamental factors people have tried to use over the years to predict market cycles. Each of these may appear to be grounded in good common sense – who wouldn’t believe that, in general, a warm or moderate climate would lead to higher home price appreciation than a crummy climate, or that lower mortgage rates would lead to higher home prices?

The facts just don’t support it.

For example, the one Fundamental factor nearly everyone agreed with was that lower mortgage interest rates led to higher real estate prices… but we’ve had near-record low mortgage rates for years, while home prices fell off a cliff. Clearly that’s not a good predictor!

The bottom line is this:

Fundamental Analysis doesn’t, won’t and can’t ever work for predicting local real estate market cycles in a timely or useful way. FA will never tell you when and where you should buy, sell or hold.

Fundamentals are horribly inaccurate when it comes to predicting LOCAL real estate market cycles because each market is different. There’s no consistent formula between one market and the next.

Even if there were some magic combination of indicators (there isn’t!), they change from one time period to the next, even in the SAME local market. It’s not transferable between different markets or time periods.

Most important:

Local real estate cycles are driven by Market Psychology

…but FA ignores Market Psychology.

Technical Analysis came of age in the last thirty years with the widespread use of personal computers. TA is now the dominant technique used by savvy investors worldwide for more than $3 TRILLION in daily financial market trades.

For local real estate markets, TA is the only method on the planet that actually tracks Market Psychology and buyer behavior.

Technical Analysis is a powerful, visual system based on charts, not endless data tables. TA incorporates every element affecting price for every local real estate market, and it ignores all the irrelevant, time consuming and useless data that is not impacting real estate prices in that market.

TA does NOT require endless data collection because it’s already done for you for every market and every time period.

If you can read a red, yellow and green traffic light, you can master your markets in minutes.

By following a time-tested, proven technology, you can go from “guessing and stressing” to “investing and resting” with TOTAL CONFIDENCE and GRATITUDE.